Explore the latest developments concerning A 30% Decline.

A 30% Decline in the Stock Market

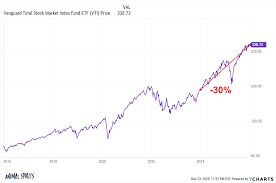

My question is about the potential troubles coming. Let’s say the market goes down 20% or even 30%. Would I be happy? No. But, investing for more than 12 years already (mostly DCA) – I am thinking about this kind of decline as a “time travel” back two or three years back. Wouldn’t this be a good thing?

Biff Tannen would have probably gotten a lot richer in Back to the Future II if he had grabbed a stock market almanac instead of the Sports Almanac.

I love relating the concept of time traveling to the stock market.

If the U.S. stock market were to fall 30% from current levels, it would take us back to where it was in January of 2024.

The S&P 500 Faces Negative Returns in 2026, GMO Warns

Every time William publishes a story, you’ll get an alert straight to your inbox!

By clicking “Sign up”, you agree to receive emails from Business Insider. In addition, you accept Insider’s

Terms of Service and

Privacy Policy.

If you're familiar with GMO, the asset management house cofounded by value investing legend Jeremy Grantham, you know the firm tends to issue bearish forecasts for the broader market.

So you may not be surprised to hear that Ben Inker, its co-head of asset allocation, sees weak returns ahead for the S&P 500 amid high concentration in expensive AI stocks.

But Inker isn't calling for the kind of spectacular bust the firm has warned of in the past. Instead, he said it's likely that AI starts to underperform and investors start to move into other areas of the market, creating a drag on the overall index — a dynamic that has periodically started to play out over the last few months.

AMAZING YAMAGUCHI Deadpool 2.0 Grey Action Figure Mutants Joint Movable KAIYODO Wade SHF Model Movie Toys for Kids Gift

A Decline Is Coming, But Think 2021, Not Dot-Com (SP500)

A decline is coming. If you disagree, you have forgotten the intrinsic laws of the universe. When valuations exceed intrinsic value, return magnitude probability diminishes. Investing without algorithmically transcendent processes on any other premise deserves one name and one name only—speculation. We had a bit of

Analyst’s Disclosure:I/we have a beneficial long position in the shares of NVDA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

For more detailed information, explore updates concerning A 30% Decline.