Explore the latest developments concerning How BlackRock, world's.

How BlackRock, world's largest asset manager, is fine-tuning market portfolios for 2026

BlackRock came into 2026 with a clear investment plan built around three pillars: artificial intelligence, income, and diversification.

Jay Jacobs, BlackRock's head of equity exchange-traded funds, laid out ways in which ETFs fit into the shifting market bets from the world's largest asset manager, which oversees more than $13 trillion from investors. Investors should remain focused on growth, he says, but precision will matter more than broad exposure.

"The first is really what are the biggest growth opportunities in the market today," Jacobs said on CNBC's "ETF Edge" on Monday. "Where you have to get laser focused to try and find some of these targeted exposures, like artificial intelligence, that could do very well in this environment."

AI is 'no longer the only game in town'

AI stocks have been powering the market rally for the last couple of years. But BlackRock Head of iShares Investment Strategy for the Americas, Kristy Akullian, says that AI is "no longer the only game in town." In the video above, hear her take on the markets and how to play them now with ETFs.

To watch more expert insights and analysis on the latest market action, check out more Market Catalysts.

With AI remaining a dominant theme and expectations of easing policy rates,

we're looking at how to play it all in this week's ETF report brought to you by Invesco QQQ.

JHK Desser For Bedroom With 7 Fabric Drawers Organizer Storage Closet Chest Clothes For Living Room Display Cabinet Of Furniture

BlackRock changes course in the US after $38 trillion in debt and rumors of a $2,1 trillion exit gain traction; the asset manager is underweighting long-term Treasuries and reinforcing global diversification, with impacts on interest rates and portfolios.

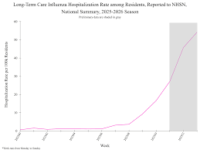

In 2026, BlackRock changes course in the US. Amidst an interpretation of fiscal deterioration and shifting capital flows, in a scenario where national debt is cited as US$38,4 trillion in December 2025after climbing from US$36,1 trillion in January 2025, an increase in US$2,3 trillion in 11 months.

Reorientation is described as a response to an environment in which Long Treasuries become underweighted And global diversification is gaining priority, alongside debates about the immediate impact on interest rates. liquidity and portfolio composition, with the assumption of capital outflow and a gradual reduction of exposure to the dollar.

The starting point is the understanding that American debt is already a "real accumulated" figure, with books closed "from December 2025 onwards," and not a future projection.

For more detailed information, explore updates concerning How BlackRock, world's.

0 Comments